Lockheed Martin published its First Quarter financial results this morning, and highlights included the following:

- The company reported net sales of $15.0 billion

- Lockheed Martin had net earnings of $1.7 billion, or $6.44 per share

- Cash from operations were $1.4 billion and free cash flow of $1.1 billion

- The company paid $2.8 billion of cash to shareholders through share repurchases and dividends

- The company reaffirmed its 2022 financial outlook

The aeronautics division had an increase in net sales compared to the first quarter of 2021, but a drop in operating profit from the division.

The company described the reason for this in their press release:

Aeronautics’ net sales during the first quarter of 2022 were comparable to the same period in 2021. Net sales increased by approximately $80 million for the F-16 program due to higher volume on production contracts that was partially offset by an unfavorable profit adjustment on a modernization contract. This increase was offset by lower net sales of approximately $65 million for the F-35 program due to lower net favorable profit adjustments and volume on production contracts that were partially offset by an unfavorable profit adjustment on a development contract in the first quarter of 2021 that did not recur in the first quarter of 2022.

Here are the company’s results broken down by segment:

| (in millions) | Quarters Ended | |||||

| March 27, 2022 | March 28, 2021 | |||||

| Net sales | ||||||

| Aeronautics | $6,401 | $6,387 | ||||

| Missiles and Fire Control | $2,452 | $2,749 | ||||

| Rotary and Mission Systems | $3,552 | $4,107 | ||||

| Space | $2,559 | $3,015 | ||||

| Total net sales | $14,964 | $16,258 | ||||

| Operating profit | ||||||

| Aeronautics | $679 | $693 | ||||

| Missiles and Fire Control | $384 | $396 | ||||

| Rotary and Mission Systems | $348 | $433 | ||||

| Space | $245 | $227 | ||||

| Total business segment operating profit | $1,656 | $1,749 | ||||

| Unallocated items | ||||||

| FAS/CAS operating adjustment | $426 | $489 | ||||

| Severance and restructuring charges | — | $(36) | ||||

| Other, net | $(149) | $(20) | ||||

| Total unallocated items | $277 | $433 | ||||

| Total consolidated operating profit | $1,933 | $2,182 | ||||

“Lockheed Martin had a solid start to the year by delivering margin expansion and free cash flow above our expectations despite recent Covid-surge impacts on our operations and supply chain. We remain confident in our guidance for the remainder of the year and our growth outlook beyond,” said Lockheed Martin Chairman, President and CEO James Taiclet, as reported in the press release.

“Global events this quarter marked a dramatic change in the geopolitical environment and demonstrated the tremendous importance of an effective deterrent to aggression by major nation-states, and mutual defense among the United States and its allies. The men and women of Lockheed Martin are fully dedicated to enhancing this deterrence capability by effectively delivering on our existing platform programs and systems, while accelerating the integration of digital world technologies to enable true Joint All Domain Operations for our customers.”

The company published the following summary table of financial results:

| (in millions, except per share data) | Quarters Ended1 | |||||

| March 27, 2022 | March 28, 2021 | |||||

| Net sales | $14,964 | $16,258 | ||||

| Business segment operating profit2 | $1,656 | $1,749 | ||||

| Unallocated items | ||||||

| FAS/CAS operating adjustment | $426 | $489 | ||||

| Severance and restructuring charges3 | — | $(36) | ||||

| Other, net4 | $(149) | $(20) | ||||

| Total unallocated items | $277 | $433 | ||||

| Consolidated operating profit | $1,933 | $2,182 | ||||

| Net earnings3,4,5 | $1,733 | $1,837 | ||||

| Diluted earnings per share3,4,5 | $6.44 | $6.56 | ||||

| Cash from operations | $1,410 | $1,748 | ||||

| Capital expenditures | $(268) | $(281) | ||||

| Free cash flow2 | $1,142 | $1,467 | ||||

| 1 | The corporation closes its books and records on the last Sunday of the calendar quarter to align its financial closing with its business processes, which was on March 27 for the first quarter of 2022 and March 28 for the first quarter of 2021. The consolidated financial statements and tables of financial information included herein are labeled based on that convention. This practice only affects interim periods, as the corporation’s fiscal year ends on Dec. 31. | |||||

| 2 | Business segment operating profit and free cash flow are non-GAAP measures. See the “Use of Non-GAAP Financial Measures” section of this news release for more information. | |||||

| 3 | Net earnings for the first quarter of 2021 includes severance and restructuring charges of $36 million ($28 million, or $0.10 per share, after-tax) for previously announced actions at Rotary and Mission Systems (RMS) business segment. | |||||

| 4 | Net earnings for the first quarters of 2022 and 2021 include net losses of $101 million ($76 million, or $0.28 per share, after-tax) and $10 million ($8 million, or $0.03 per share, after-tax) due to declines in the fair value of investments held in a trust for deferred compensation plans. | |||||

| 5 | Net earnings for the first quarters of 2022 and 2021 include net gains of $103 million ($77 million, or $0.29 per share, after-tax) and $68 million ($51 million, or $0.18 per share, after-tax) due to increases in the fair value of investments held in the Lockheed Martin Ventures Fund. | |||||

Lockheed Martin and Cobb County

The Lockheed Martin facility in Marietta has been a major employer in Cobb County since 1951, when the Lockheed Corporation, a predecessor of Lockheed Martin, took over the former site of the WWII Bell Bomber plant.

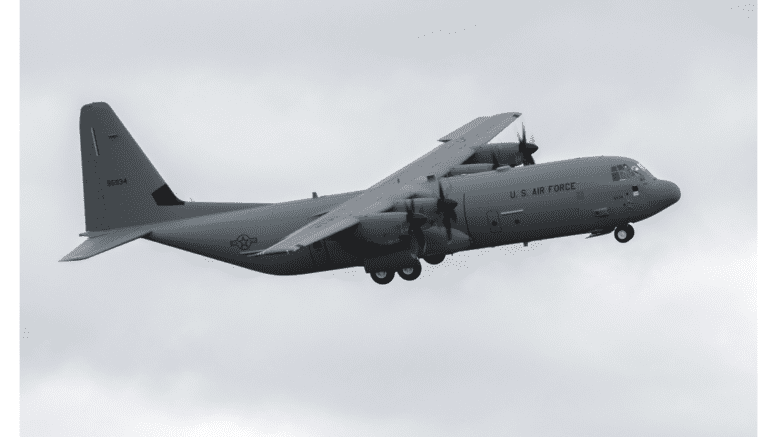

The C-130 program is the largest program operating at the Marietta facility. The plant currently produces the C-130J Super Hercules (see the company’s Fast Facts on the C-130J or the company’s C-30J brochure for more information).

The Marietta plant also provides ongoing support for the C-5 Galaxy, which celebrated its 50th year in operation in 2018. The C-5 Galaxy is expected to remain in service until 2045.

The Marietta location also supports the P-3 Orion, and manufactures the center wings for the F-35.