by Bryan Keogh, The Conversation, [This article first appeared in The Conversation, republished with permission]

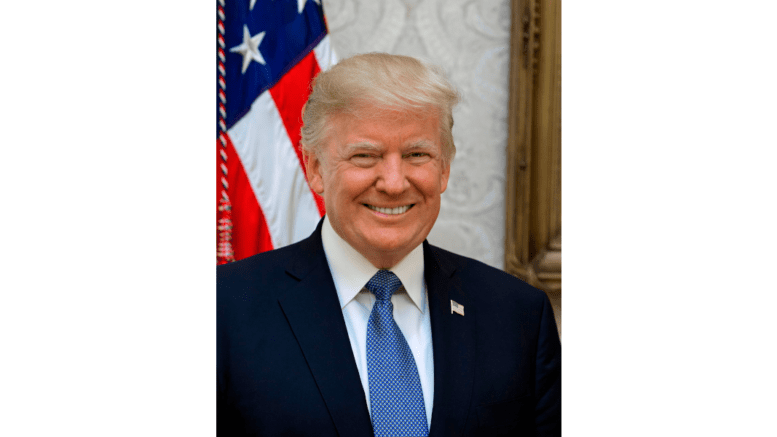

The tax records of Donald Trump, details of which were released on Dec. 21, 2022, show the former president used the same aggressive measures to avoid paying high taxes while in office as he did during his business career. Indeed, he paid zero tax in 2020 – the last full year of his presidency – according to figures released by the House Ways and Means Committee in one of its last moves under Democratic control. The panel plans to release redacted versions of six years’ worth of tax returns soon.

The Conversation has been covering Trump’s taxes since he began his run for the presidency in 2015. These articles from our archive, all published in the run-up to the 2020 election, explore tax-paying ethics, problems with the U.S. tax code and why the working poor are audited almost as much as the rich.

1. The honor of paying taxes

Many wealthy Americans, including Trump, take great pains and spend a lot of money on accountants to minimize their tax bill, often by mining the tax code for loopholes or even filing fake tax returns. For some, tax avoidance – which is different from illegal tax evasion – is even considered patriotic, and rich people often boast paying little to no taxes. In contrast, ancient Athenians bragged about paying their taxes, Thomas Martin, a professor of the classics at College of the Holy Cross, wrote in 2020.

“In ancient Athens, only the very wealthiest people paid direct taxes, and these went to fund the city-state’s most important national expenses – the navy and honors for the gods,” he explained. “While today it might sound astonishing, most of these top taxpayers not only paid happily, but also boasted about how much they paid.”

2. The ethics of paying taxes

Perhaps the well-to-do of Athens relished the prospect of paying their dues, but is it unethical to go out of your way to avoid them?

Erin Bass, who studies business ethics at the University of Nebraska, Omaha, addressed this question from a philosophical perspective, exploring how different ethical thinkers would approach the topic. Deontologists like Immanuel Kant, utilitarians like John Stuart Mill and virtue ethicists like Aristotle all reach different conclusions about whether tax avoidance is ethical, Bass explained.

But she added:

“When it comes to Trump and other public figures, there is an additional ethical concern at play here. Public leaders are evaluated not just on their own personal morality, but also by what influence their behaviors could have on others,” she wrote. “If a public leader avoids taxes, it might signal to the public to do the same, which could have greater consequences.”

3. What’s wrong with the US tax code?

While some say that Trump and others are smart for minimizing their taxes, critics say they’re amoral tax cheats.

To Gary Winslett, an assistant professor of political science at Middlebury, “it reveals just how much is wrong with the U.S. tax code, which Congress treats as a sort of policy Swiss Army knife to deal with innumerable desired social and economic policy goals, from homeownership to protecting the Maine blueberry industry.”

This has made the U.S. income tax system very complicated for regular taxpayers. It led to the many loopholes and other means by which the wealthy can reduce their tax payments to levels others find unfair.

4. Auditing the working poor

Another finding of the House panel is that the IRS didn’t audit Trump’s tax returns during the first two years of his presidency, even though it was required to do so.

This raises an important point: Although audits are often seen as mainly targeting the rich, the reality is the working poor are audited at rates almost as high, explained Hayes Holderness, an assistant professor of law at the University of Richmond.

“The IRS’s limited resources mean that auditors end up focusing their attention on cases with more straightforward issues and more accessible information,” he wrote. “That’s why lower-income individuals receiving the earned income tax credit were audited at a 1.2% rate in 2016, the most current year of mostly complete data, comparable to the audit rate of roughly 1.5% for individuals earning over $500,000.”

Bryan Keogh, Deputy Managing Editor and Senior Editor of Economy and Business, The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.