Lockheed Martin Corporation announced in a press release that it transferred about $4.3 billion in gross pension obligations by purchasing group annuity contracts from Athene Holding Ltd. This obligates Athene Holding to pay and administer the retirement benefits.

The company made a similar purchase in the August of 2021 (follow this link to read our article about the previous annuity purchases). At the time of that transaction the Courier spoke with Associate Professor Dr. John Abernathy, CPA, PhD, of Kennesaw State University’s Coles College of Business, who explained retirement annuity purchases to us via an email exchange (follow this link to read Dr. Abernathy’s explanation).

The Courier contacted Lockheed Martin to ask how this relates to last year’s purchase. A company spokesperson said this purchase is for a different set of retirees.

For more information read the press release from Lockheed Martin, reprinted below:

Lockheed Martin Corporation (NYSE: LMT) today announced it has purchased group annuity contracts from Athene Holding Ltd. (NYSE: ATH), a leading retirement services company. Under the contracts, Lockheed Martin will transfer approximately $4.3 billion of its gross pension obligations and related plan assets for approximately 13,600 U.S. retirees and beneficiaries to Athene. The contracts were purchased using assets from Lockheed Martin’s master retirement trust and no additional funding contribution was required as part of this transaction.

On Jan. 1, 2023, Athene will begin paying and administering the retirement benefits of the affected retirees and beneficiaries in the Lockheed Martin Corporation Salaried Employee Retirement Program and the Lockheed Martin Aerospace Hourly Pension Plan. The transaction will result in no changes to the benefits received by retirees and beneficiaries. Transferred pension benefits are subject to the protections offered by the State Guaranty Association in the states where the retirees and beneficiaries live. Affected retirees and beneficiaries will receive a letter with additional details about the transfer.

In connection with this transaction, the company expects to recognize a non-cash, non-operating settlement charge of approximately $1.5 billion ($1.2 billion, or $4.50 per share, after tax) in the second quarter of 2022, related to the accelerated recognition of actuarial losses for the affected plans that were included in stockholders’ equity. The actual settlement charge will depend on finalization of the actuarial assumptions, including discount rate and investment rate of return, as of the measurement date. The charge was not included in the company’s prior 2022 financial outlook released on April 19, 2022, and the company will provide an update to its 2022 financial outlook with its second quarter earnings release.

Lockheed Martin and Cobb County

The Lockheed Martin facility in Marietta has been a major employer in Cobb County since 1951, when the Lockheed Corporation, a predecessor of Lockheed Martin, took over the former site of the WWII Bell Bomber plant.

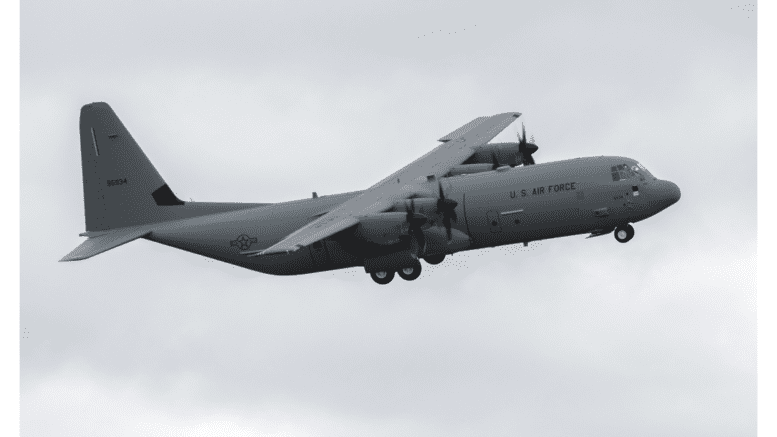

The C-130 program is the largest program operating at the Marietta facility. The plant currently produces the C-130J Super Hercules (see the company’s Fast Facts on the C-130J or the company’s C-30J brochure for more information).

The Marietta plant also provides ongoing support for the C-5 Galaxy, which celebrated its 50th year in operation in 2018. The C-5 Galaxy is expected to remain in service until 2045.

The Marietta location also supports the P-3 Orion, and manufactures the center wings for the F-35.